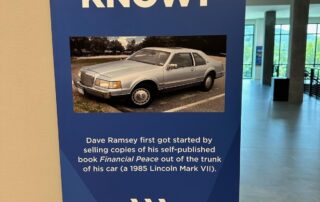

Dave Ramsey’s Nashville Headquarters

Dave Ramsey is one of America’s most trusted voices on personal finance matters. He shares his money-management expertise on the radio, online and through several best-selling books. His goal is to help Americans build wealth through saving, living debt-free and making calculated investments.

SmartVestor is a free service that connects individuals with a network of financial professionals who are aligned with Dave Ramsey’s approach to financial freedom. Brian has earned the credential of SmartVestor Pro through his industry experience and his drive to help others. He believes everyone deserves access to solid, professional investing guidance.

Improve Your Finances with Dave Ramsey’s 7 Baby Steps

Kickstart an Emergency Fund

Save $1,000 as fast as you can. This emergency fund will cover those unexpected life events you can’t plan for — and there are plenty of them!

Pay Off All Your Debt

Create a list of all debts, excluding your mortgage, from smallest to largest balance and use the debt snowball method to knock them out one by one.

Get Fully Funded for Emergencies

With your debts paid off, focus on fully funding an emergency fund that can comfortably cover 3-6 months of your expenses so debt doesn’t return.

Invest in Your Retirement

Now it’s time to get serious about your retirement. Take 15% of your household income and invest it, starting with your company’s 401(k) and a Roth IRA.

Create a College Fund

With debt in the rearview and your retirement savings activated, save for your children’s college expenses by opening a 529 college savings plan.

Pay Off Your Home Early

Bring it all home by paying off the big dog. Put any extra money you can toward your mortgage and discover the joys of becoming completely debt free!

Build Wealth and Give

Once truly debt free, it’s time to have some fun! Live and give like no one else by continuing to build wealth while leaving an inheritance for loved ones.

The SmartVestor Pro Commitment

With a SmartVestor Pro, you know you’re getting the same type of advice Dave Ramsey would give.

Why use a SmartVestor Pro investing professional?

A good investing pro does more than pick your funds. Brian will fit your investments into your life, consider tax implications and changes in legislation, and educate you so you’ll understand what you’re investing in and why.

Say you’re having a bad day and want to sell all of your investments. That split-second decision can ruin the goals you’ve worked hard to achieve. Buying high and selling low is a bad plan; an investing pro will intervene to remind you why you’re investing and encourage you to stick with your long-term goals.

Pros like Brian are vetted and trusted by the Dave Ramsey team to take care of you and your investments.